rhode island tax rates 2020

1463 for Real Estate and Tangible Property. 34 cents per gallon of regular gasoline and diesel.

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

The top rate for the Rhode Island estate tax is 16.

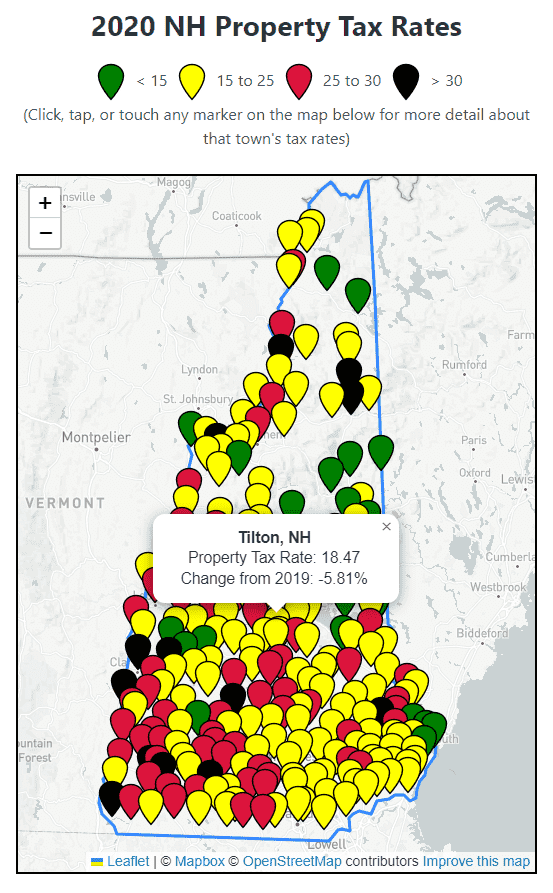

. 2020 Rhode Island Property Tax Rates Hover or touch the map below for more tax rate. State of Rhode Island Division of Municipal Finance Department of Revenue. Above rates do not include Job Development Assessment of 21 or 008 adjustment for 2020.

The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Start filing your tax return now. Detailed Rhode Island state income tax rates and brackets are available on. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

About Toggle child menu. 41 rows Rhode Island Property Tax Rates. The UI taxable wage base will be 24600 for most employers and 26100.

15 Tax Calculators. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. RI or Rhode Island Income Tax Brackets by Tax Year.

Detailed Rhode Island state income tax rates and brackets are available on this page. The federal corporate income tax by contrast has a marginal bracketed corporate. Rhode Island Tax Brackets for Tax Year.

3 West Greenwich - Vacant land taxed at. 2 Municipality had a revaluation or statistical update effective 123119. If you live in Rhode Island and are thinking about estate planning this.

It kicks in for estates worth more than 1648611. Recent Tax Rate History - Tax Rates from 1893 - 1996. Rhode Island Income Tax Rate 2022 - 2023.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort. Exemptions to the Rhode Island sales tax will vary by state.

Rhode Island new employer rate. Compare your take home after tax and estimate. Tax Rate 0.

2020 Rhode Island Property Tax Rates on a Map - Compare Best and Worst RI Property Taxes Easily. 1 Rates support fiscal year 2020 for East Providence. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

TAX DAY IS APRIL. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. Like most other states in the Northeast Rhode Island has.

Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Rhode Islands tax brackets are indexed for. 153 average effective rate.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Tax Assessor City Of Pawtucket

Reopened Here S What Is Open In Rhode Island And Massachusetts Wpri Com

Where S My Refund Rhode Island H R Block

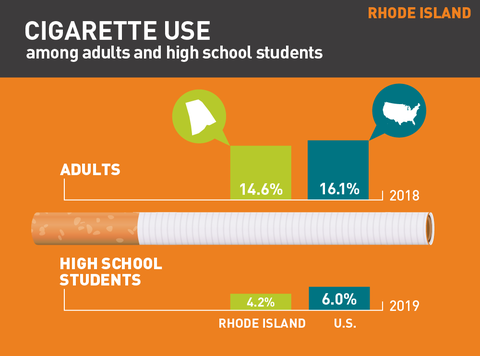

Tobacco Use In Rhode Island 2020

Map Of Rhode Island Property Tax Rates For All Towns

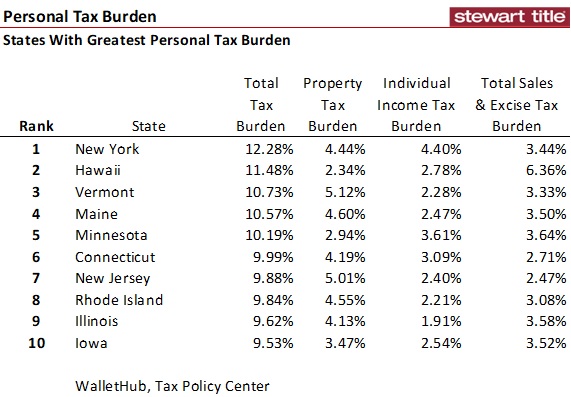

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Historical Rhode Island Tax Policy Information Ballotpedia

Individual Income Tax Structures In Selected States The Civic Federation

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

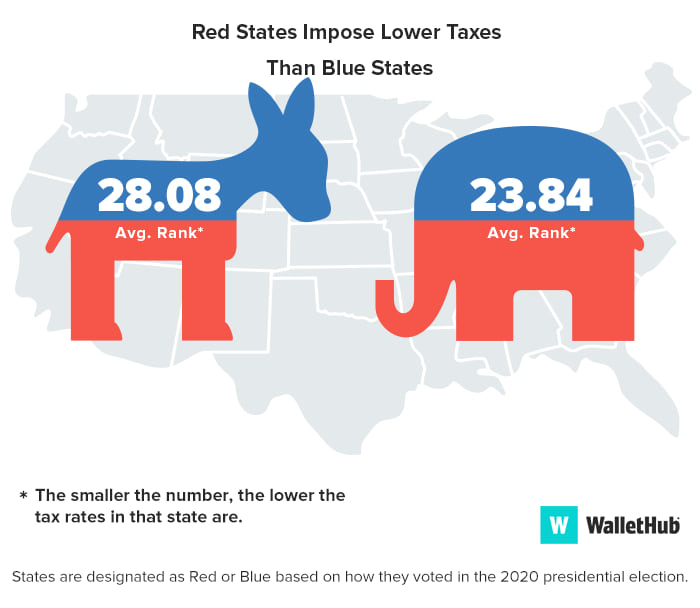

States With The Highest Lowest Tax Rates

Rhode Island Income Tax Ri State Tax Calculator Community Tax

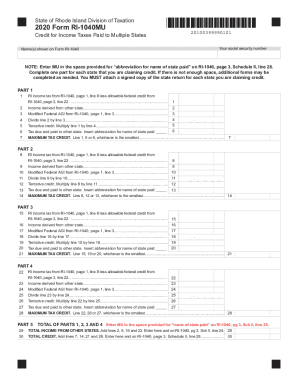

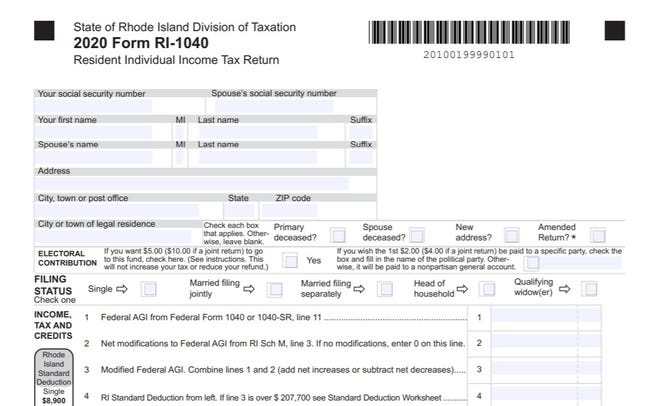

Ri 1040 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

Tax Collector Town Of Hopkinton Rhode Island Usa

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation